missouri employer payroll tax calculator

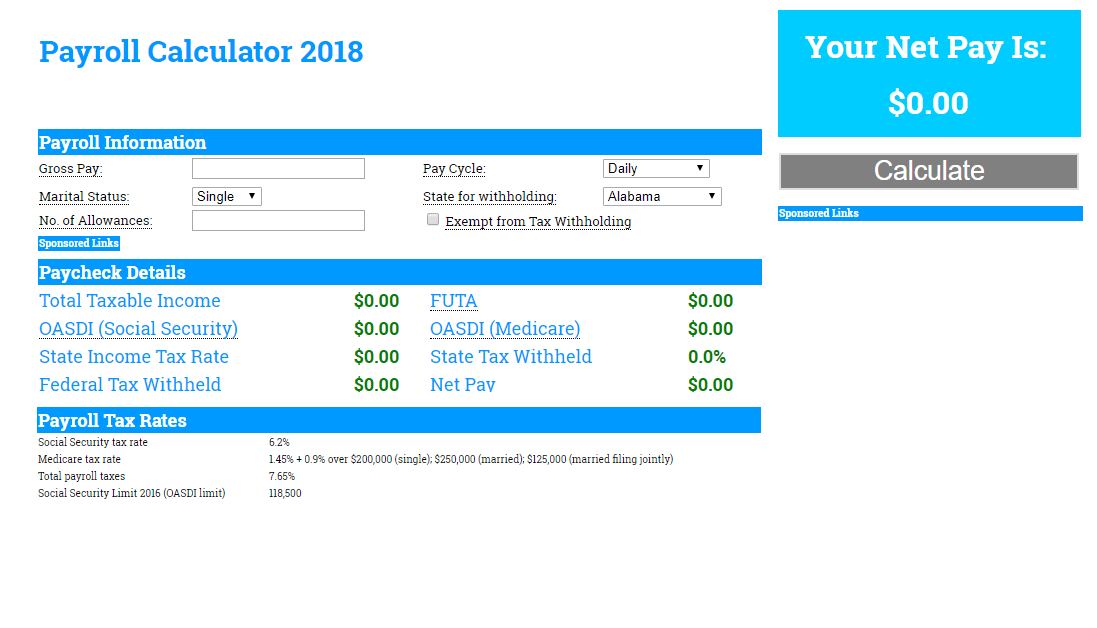

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. Ad Compare This Years Top 5 Free Payroll Software.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

. Additions to Tax and Interest Calculator. That tax rate hasnt changed since 1993. Missouri is currently not a credit reduction state.

Employees with multiple employers may refer to. Missouri Salary Paycheck Calculator. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

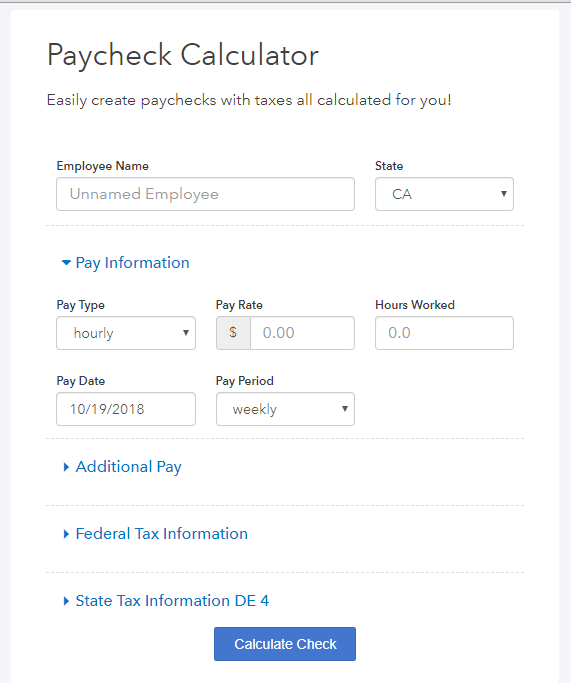

Missouri Cigarette Tax. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The state income tax rate in Missouri is progressive and ranges from 0 to 53 while federal income tax rates range from 10 to 37 depending on your income. Just enter the wages tax withholdings and other information required. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Employers withholding 100 per quarter to 499 per month must file and pay on a quarterly. Missouri Hourly Paycheck Calculator.

Taxes Paid Filed - 100 Guarantee. Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. Employers withholding 500 to 9000 per month must file and pay on a monthly basis.

Missouri New Hire Reporting. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated. Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20.

Jefferson City MO 65105-3340. The standard FUTA tax rate is 6 so your max. Free Unbiased Reviews Top Picks.

So the tax year 2022 will start from July 01 2021 to June 30 2022. The maximum an employee will pay in 2022 is 911400. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Employers can use the calculator rather than manually looking up. Free Unbiased Reviews Top Picks. If you have misplaced this identification number and are an authorized person for the account you may call 573 751-5860 to obtain.

Missouri Payroll for Employers. All corporations and manufacturers doing business in the state. Missouri Tax Registration Application Form 2643.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Compare This Years Top 5 Free Payroll Software.

Employers covered by Missouris wage payment law must pay wages at least semi-monthly. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Employer Withholding Tax - Missouri The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Whose Income Is Considered When Calculating Child Support Dadsdivorce Com Ch Child Support Quotes Mo Child Support Child Support Quotes Ways To Save Money

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Sales Lead Form Template Best Of Sales Tracking Spreadsheet Template Tracking Spreadsheet Spreadsheet Template Excel Spreadsheets Templates Sales Template

Pay Check Stub Payroll Checks Payroll Payroll Template

Pay Stub Maker Online Free Paystub Maker Tool For Your Stubs Stubcreator Payroll Template Templates Bad Credit Score

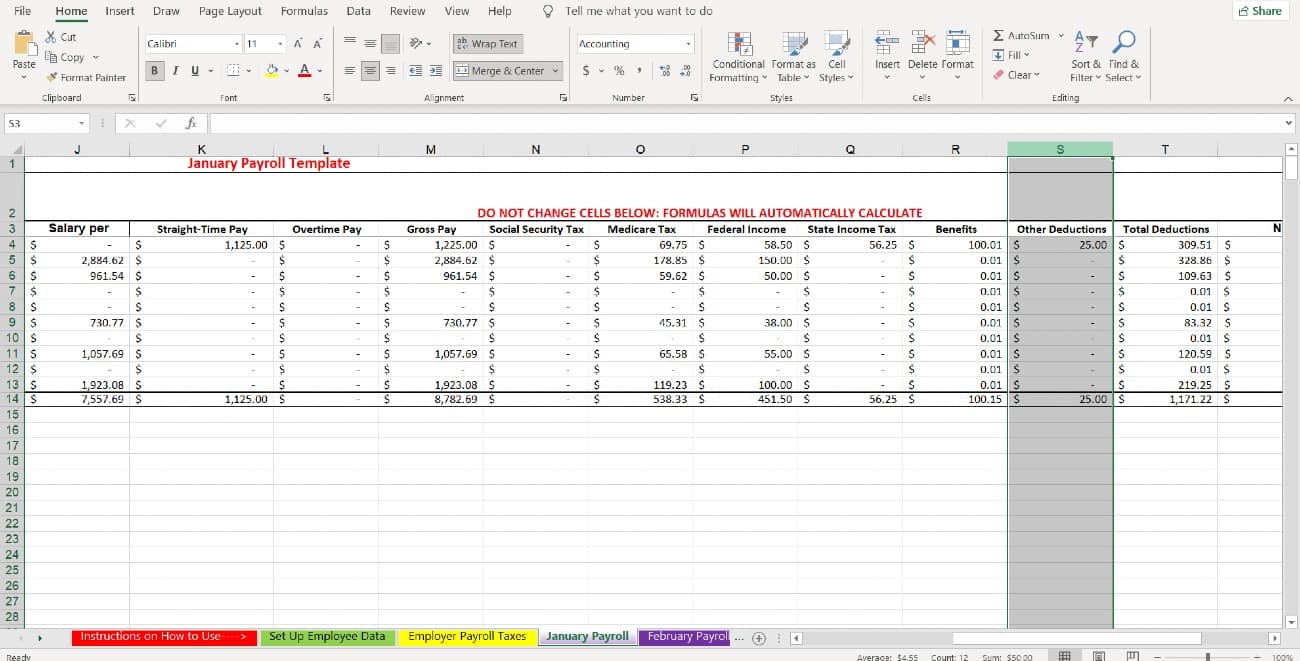

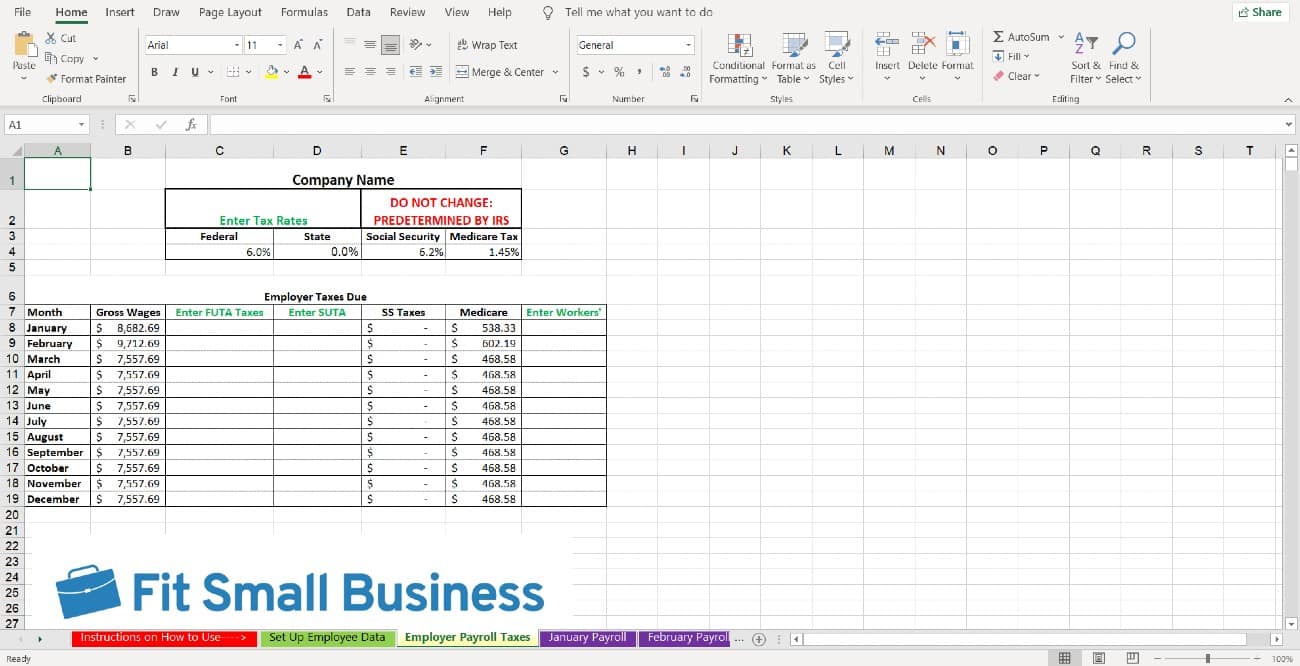

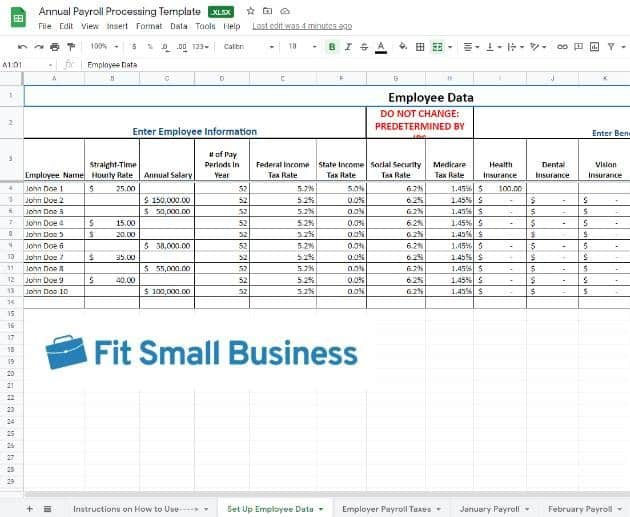

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

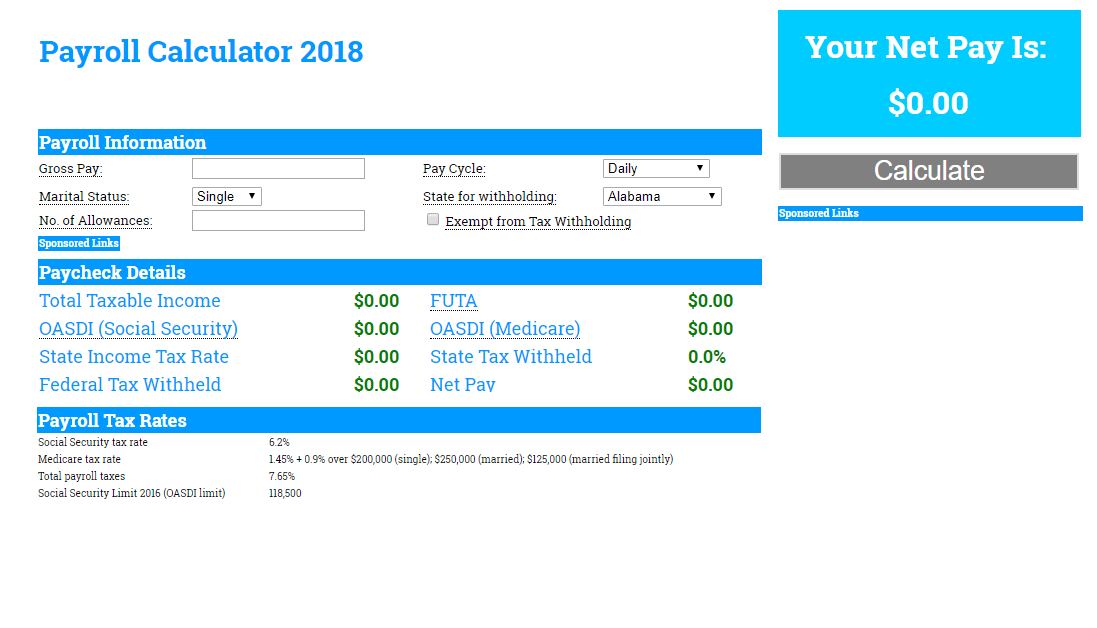

Payroll Tax Calculator For Employers Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

Self Employment Ledger Forms Beautiful Self Employment Ledger Template Excel Free Download Being A Landlord Self Employment Self

Free Check Stub Template Printable Payroll Template Statement Template Payroll Checks

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Do Payroll In Excel In 7 Steps Free Template

5 Printable Pay Stub Templates In Word Format Printablepaystub Stubtemplates Pintablepaystub Word Template Templates Words

Payroll Tax Calculator For Employers Gusto

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp